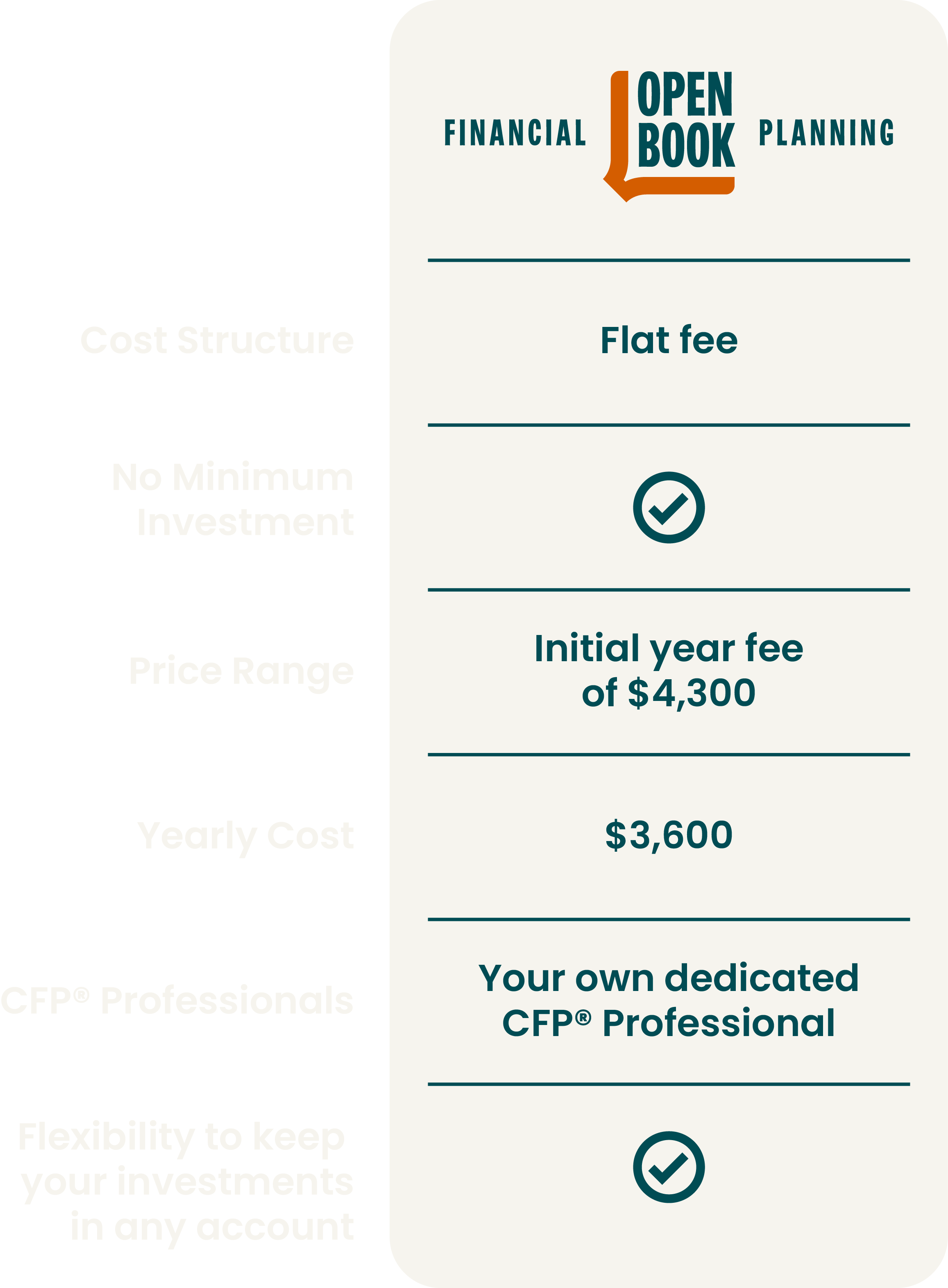

TRANSPARENT, CONFLICT-FREE PRICING

At OPEN BOOK FINANCIAL PLANNING, we believe in CLEAR, STRAIGHTFORWARD PRICING with no hidden fees, commissions, or asset-based charges.

HOURLY RATE: $350.00

WORK SESSION: $600.00 If you have one specific issue that you just need help with, I offer a two-hour block where I'll work with you to solve that issue. For example, "how much life insurance do I need and what type?" (if the session goes over two hours, the standard hourly rate applies.)

COMPREHENSIVE FINANCIAL PLAN: $4,500.00

ONGOING PLANNING (NEW CLIENTS): $4,300.00 for the first year, $1,000.00 in the first month, and $300.00/month going forward.

ONGOING PLANNING (AFTER YEAR ONE): $3,600.00/year (broken up into monthly payments of $300.00)

Our FLAT-FEE, ADVICE ONLY approach ensures that you receive UNBIASED FINANCIAL GUIDANCE, tailored to your needs—without sales pressure or conflicts of interest.

Most advisors charge a percentage of the money they manage for you — known as an “Asset Under Management” (AUM) fee. AUM fees typically range from 0.25–1.5%. With the AUM model the more your money grows the more you pay.

We don’t charge AUM fees, we charge a flat fee — use this tool to see which is best for you.

The calculator provided on this page is for illustrative purposes only and any results it provides are hypothetical in nature and may not reflect future performance. The calculation used is a simple future value estimate of investments based on a constant return rate and a predefined period. The future value calculation in the Annual Fee scenario reduces the current portfolio value by $3,600. The Traditional RIA scenario assumes an annual 1% assets under management fee which reduces the the annual return by that amount. The default 8% return is based on the average S&P 500 return rate of 10% between 1926 and 2022 and an 2% inflation adjustment for a real return of 8%.

HOW DO WE COMPARE?

WHAT IS A FIDUCIARY?

A fiduciary is a professional who is legally and ethically bound to act in their client’s best interest at all times. In the financial industry, a fiduciary financial advisor must provide objective, conflict-free advice that prioritizes the client’s needs over their own compensation.

Unlike commission-based advisors who may be incentivized to sell financial products, a fiduciary must always recommend what is truly best for you, without being influenced by commissions, hidden fees, or sales quotas. Fiduciaries are held to the highest standard of care, ensuring transparency, honesty, and full disclosure in all financial guidance.

At OPEN BOOK FINANCIAL PLANNING, we operate as a FLAT-FEE FINANCIAL ADVISOR, meaning we have no hidden incentives, no product sales, and no asset-based fees—just unbiased, fiduciary financial advice designed to help you achieve your goals with confidence.

HOW DO I KNOW IF MY FINANCIAL ADVISOR IS A FIDUCIARY?

Not all financial advisors are fiduciaries, and many operate under different compensation models that may create conflicts of interest. Here’s how you can determine if your financial advisor is truly working in your best interest:

ASK THEM DIRECTLY

1.

“Are you a fiduciary at all times when giving me financial advice?”

A TRUE FIDUCIARY will answer YES, without hesitation. Some advisors only act as fiduciaries in certain situations and may still sell commission-based products.

Check Their Compensation Model

2.

A fiduciary should not earn commissions or referral fees from the financial products they recommend.

FEE-ONLY ADVISORS (like flat-fee or hourly advisors) are typically FIDUCIARIES because they are paid solely for their advice.

COMMISSION-BASED ADVISORS may sell financial products (like annuities, mutual funds, or insurance) and earn a commission, which can create conflicts of interest.

AUM (ASSETS UNDER MANAGEMENT) ADVISORS charge a percentage of your investments, which may influence their recommendations.

Look for Fiduciary Credentials

3.

Advisors who hold the following designations are typically fiduciaries:

CERTIFIED FINANCIAL PLANNER (CFP®) – Required to act as a fiduciary when providing financial planning services.

CHARTERED FINANCIAL CONSULTANT (ChFC®) – Follows fiduciary principles.

REGISTERED INVESTMENT ADVISOR (RIA) – Legally obligated to act as a fiduciary.

Review Their ADV Form

4.

Registered Investment Advisors (RIAs) are required to file a FORM ADV, which discloses their compensation model and any potential conflicts of interest. You can look up your advisor’s Form ADV on the SEC’S INVESTMENT ADVISER PUBLIC DISCLOSURE WEBSITE.

Read Their Disclosures Carefully

5.

Some advisors may CLAIM to be fiduciaries but have fine print that allows them to sell commission-based products. Look for wording like:

"We act as a fiduciary in some cases but may receive commissions in others."

"We have a duty to act in your best interest, but we may also receive compensation from third parties."

THE BOTTOM LINE

A TRUE FIDUCIARY ADVISOR is 100% COMMITTED TO ACTING IN YOUR BEST INTEREST—AT ALL TIMES. If an advisor earns commissions or manages assets for a percentage, they may not always provide COMPLETELY UNBIASED ADVISE.

At OPEN BOOK FINANCIAL PLANNING, we operate as a FLAT-FEE FINANCIAL ADVISOR, meaning we have NO COMMISSIONS, NO ASSET-BASED FEES, AND MINIMAL CONFLICTS OF INTEREST. Our only priority is helping YOU make the BEST FINANCIAL DECISIONS for your FUTURE.

Are All Fee-Only Advisors Fiduciaries?

No, NOT ALL FEE-ONLY ADVISORS ARE FIDUCIARIES—but most are. The FEE-ONLY compensation model reduces conflicts of interest because advisors do not earn commissions from financial product sales. However, just because an advisor is fee-only does NOT AUTOMATICALLY mean they are legally obligated to act as a fiduciary at all times.

Fee-Only vs. Fiduciary – What’s the Difference?

FEE-ONLY ADVISORS get paid directly by their clients, not by third parties. This means they do not receive commissions from mutual funds, insurance policies, or annuities.

FIDUCIARY ADVISORS are legally required to act in their clients’ BEST INTERESTS AT ALL TIMES, disclosing any potential conflicts and ensuring their advice is free from external influence.

When Might a Fee-Only Advisor Not Be a Fiduciary?

Even within the fee-only model, some advisors may have CONFLICTS OF INTEREST or limitations, such as:

NOT BEING AN RIA (REGISTERED INVESTMENT ADVISOR) – Only RIAs and their representatives are legally bound by fiduciary duty.

OPERATING UNDER A SUITABILITY STANDARD IN CERTAIN SITUATIONS – Some advisors may be dually registered, meaning they are FIDUCIARIES WHEN GIVING FINANCIAL PLANNING ADVICE but could switch to a non-fiduciary role when recommending certain investments.

CHARGING FEES THAT COULD INTRODUCE BIAS – Even fee-only advisors who charge AUM FEES (Assets Under Management) may have incentives to KEEP MORE OF A CLIENT’S ASSETS INVESTED rather than recommending strategies like paying off debt or making large charitable donations.

How to Know If a Fee-Only Advisor Is a Fiduciary

To ensure an advisor is BOTH FEE-ONLY and a TRUE-FIDUCIARY, ask:

Are you a fiduciary at all times?

Do you receive any commissions, referral fees, or outside compensation?

Are you legally bound to act in my best interest 100% of the time?

THE BOTTOM LINE

Most fee-only advisors ARE fiduciaries, but it’s important to verify that they act in a fiduciary capacity AT ALL TIMES. At OPEN BOOK FINANCIAL PLANNING, we operate as a FLAT-FEE FINANCIAL ADVISOR, ensuring that every recommendation is 100% IN YOUR BEST INTEREST–ALWAYS.